Your Retirement Powered by Startups

Access the whole startup ecosystem and defer taxes no matter how much profit you make in an exit.

Invest in syndicates, seed rounds and the whole startup ecosystem right in your self directed retirement plan. 🎉

Defer Taxes on exit profits

With a tax-deferred self directed retirement plan, you won’t incur capital gains taxes. No matter how much profit you make in an exit, it all compounds into the next deal, the deal after, and so forth.

Stay Fully Compliant

Backed by the top tax and legal experts, Nabers guides you through staying compliant so you can focus on finding smart deals and generating & keeping your profits.

Access The Whole Startup Ecosystem

Get unfettered access to invest in syndicates, seed rounds, SAFEs, Series A/B/C/D, crowdfunding and the whole startup ecosystem.

Use Startups to Generate Retirement Income

Some startups might distribute profits as dividends which can be used as retirement income. Or use the profits from successful exits to buy income generating assets.

Roth? You can do that too

A Self Directed Roth Retirement Plan completely eliminates the income taxes on future qualified distributions, no matter how big the profit. Enjoy the power of roth + startups.

Built-in Checkbook

There’s no need to wait weeks for processing or deal with unnecessary fees or delays. Easily do VC deals 24/7 using your digital checkbook or just reach for your provided physical checkbook.

Hold these VC assets and more...

- Syndicates

- Seed rounds

- Series A/B/C/D

- Crowdfunding

- Private companies

- IPOs

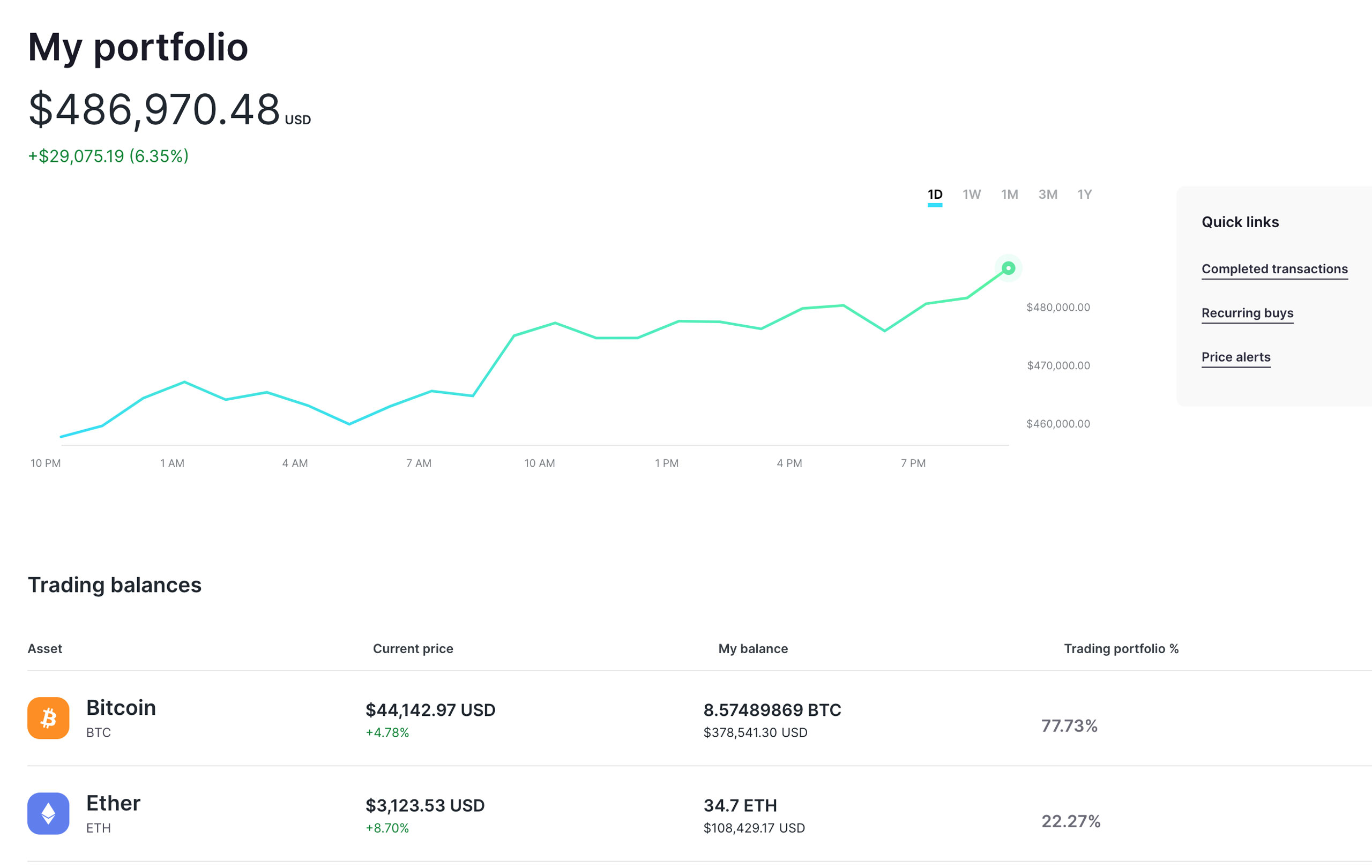

Manage your traditional and VC investments, all in one place

The world of self-directed retirement plans has never been easier thanks to our innovative investment tracker and management portal. Manage all aspects of your financial future on one easy platform!

- 📈 Easily track, buy, sell or hold your investments

- 💸 Make compliant transfers in one click

- 🔒 Data secured by 256-bit encryption

* App features shown above will be available soon.

Say goodbye to high setup fees

We didn’t stop at creating the most efficient self directed retirement plan setup process in the world.

Harness the power of Tax Deferral + Venture Capital

Don’t underestimate the power of compounding your returns combined with tax deferral, especially in an asset class like VC. Since Self Directed IRAs are fully tax-deferred, you won’t incur capital gains taxes.

Easy Maintenance and Low Fees

We've been perfecting our online setup process for over 16 years, making it the easiest and most cost-effective to use in the world. All plans include lifetime support.

Free Qualified Rollovers

We offer free rollovers from another IRA, 401(k), 403(b), 457, SIMPLE IRA, SEP IRA, Keogh, etc.

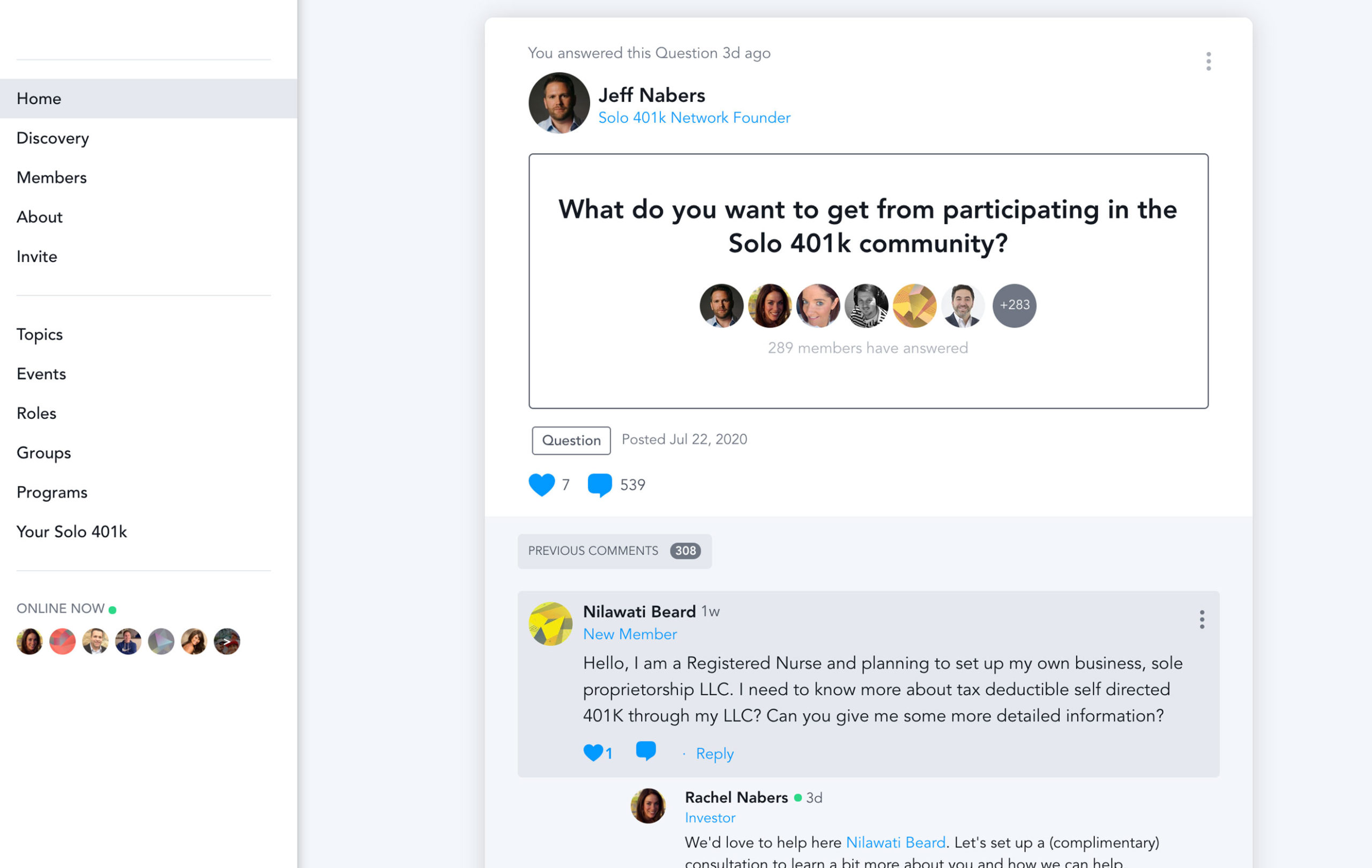

Join our plan owner community

With a Nabers self-directed retirement plan, you take complete control of your financial future and gain the freedom to invest in a wide range of assets, all in one place.

- 🗓️ Weekly webinars on all things self directed retirement

- 📖 Exclusive access to online courses

- 💭 Get answers to your questions from experts

What plan is right for you?

Just answer a few questions and we'll help you identify the self directed retirement plan that is best fit for you.